Just over a year ago, I took what I thought was my first step towards more ethical banking: I opened a Nationwide current account. Before I opened the account, I made sure to ask about the internet banking. Did it work? Was it straightforward? Easy online banking was one of the few things I liked about my old HSBC account, and I wanted to be sure Nationwide would offer the same thing. I was assured that Nationwide’s internet banking was very easy to use and naively, I believed it.

I flicked through the leaflet called “Getting Started: Internet Banking – User guide” and found it all quite straightforward. Time to get started!

The site was painfully slow to load, but I tried not to let that mar my optimistic mood. Eventually, I was in.

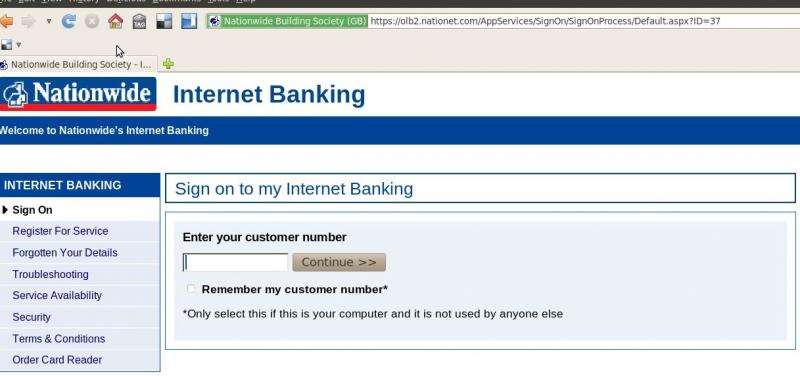

The first thing the site wanted was my customer number. I thought this would be the same thing as my account number. It wasn’t.

Then the site wanted my “memorable data”. I assumed this was the “memorable word” I’d agreed with the branch staff as a password when I opened the account. It wasn’t.

It also wanted selected digits from something called a Passnumber, which had me foxed for a while.

The first hurdle, I think, is to work out that you need to register. The Getting Started leaflet assumes you’ve already registered, referring to “your sign on details letter” and “the date, place or name you chose when you registered”, but doesn’t make it clear that registering for Nationwide internet banking is not the same thing as opening a Nationwide account. (It also has zero information on how to register, which I suppose is to be expected if it’s starting from the assumption that you’ve already done so.)

Once you work out that you have to register, you’ll realise that your “customer number” is a separate number solely used for internet banking purposes. Nationwide sends it to you by post when you first register for internet banking, though you won’t necessarily make the connection between the “security details” it says it’s sending and the “customer number” the site is demanding. In other words, Nationwide’s internet banking sign-up process involves waiting for a snail-mail letter, without necessarily even realising that you’re waiting for it.

You’ll also then work out that the “memorable data” is actually three pieces of data you’re required to supply: a place, a name and a date. (The Passnumber is supplied by Nationwide and arrives with the rest of the “security details”.)

Once the snail-mail letter arrives, you can finally get your banking set up online. But I still struggled. I kept re-entering my details and being told they were wrong. I ended up locked out of my account and having to re-register. I thought the problem might be that several days had elapsed between thinking of my “memorable data” and being able to use it online; maybe I’d managed to forget it in that time. Cue another wait for a letter in the post. Rinse and repeat.

When I registered for the third time, I threw all data security advice to the winds and wrote down my memorable data, storing it in a text file on my computer with a hacker-baffling filename like “Nationwide Internet Banking Details” or similar. But when the letter came through the post again and I re-registered again, I still got it wrong and still ended up locked out. By this point, I’d had the current account for over a month and still hadn’t managed to use the internet banking. I missed paying a credit card bill and was charged a £12 late payment fee (which Nationwide waived after I threatened to close my account).

I did eventually manage to log in successfully, only to find myself locked out when I tried to repeat the feat the following day. I realised that the problem might be with the “memorable data” bit. The site doesn’t tell you which of the three pieces of data to enter, but I phoned up to ask and was told that any one of the three should work. Then I realised that I was only having problems when I chose to enter the date as my memorable data, rather than the name or the place. I subsequently found out (though I can’t remember how) that this was because the date can only be entered in a specific format: DDMMYYYY. (Naturally, there is no clue to this in the internet banking interface or in the cheery little leaflet.)

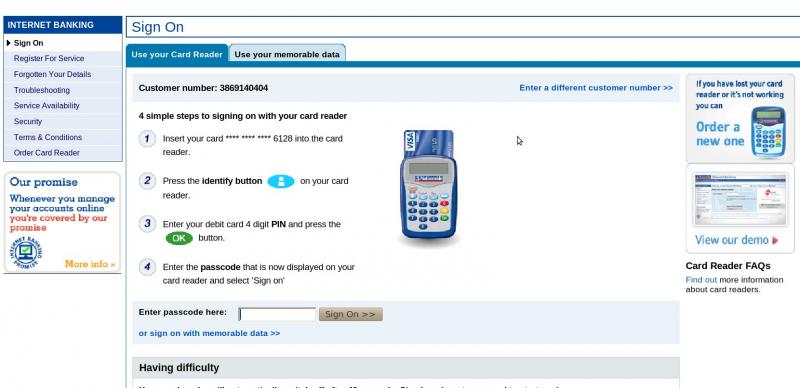

But my joy at this discovery was short-lived. The next time I tried to log in, I was faced with a demand to sign on using my card reader.

What card reader? There had been no mention of this when I opened the account and no mention in the leaflet. I rang Nationwide to ask what was going on. They said I should have already received one, but promised to send out another. In the meantime, I couldn’t use internet banking until this piece of plastic arrived by snail mail.

The card reader arrived, with a letter warning me that I could be charged for another replacement. (Of course, as far as I was concerned, it wasn’t a replacement because it was the first one I’d seen.) I followed the instructions for setting it up. It didn’t work. I rang Nationwide to complain. They assured me that the card reader was an optional measure for extra security and I could still log on to internet banking using my memorable details. I checked again and yes, “Sign on with memorable data” was given as an alternative option. I was grateful not to have to use the broken card reader.

I successfully signed in without the reader. The first thing I tried to do was to transfer money out of my current account into the HSBC joint account I share with my husband, so we could pay our (Nationwide) mortgage. But doing the transfer online was impossible without the card reader. I rang Nationwide and questioned their use of the word “optional”.

In the meantime, a second card reader arrived and I tried setting that up too. It didn’t work either. I tried googling for “Nationwide card reader” to see if there was some trick I was missing, only to witness a tide of rage from other confused and angry users.

I opened my Nationwide current account in September 2010. By March 2011 I had managed to successfully sign in to internet banking perhaps two or three times, but I still hadn’t managed to actually do anything useful like transferring money from the account. I’d been given a Nationwide credit card when I opened the account, but I stopped using it because I got sick of paying the bills by cheque.

I think I’ve made my point: Nationwide’s internet banking set-up is badly broken. Poor website usability, security theatre, unhelpful instructions and slow internal systems combine to prevent the user from, well, using it. But this lengthy rant is actually part one of a two-part story: my problems with internet banking meant that I took a long time to notice a bigger problem. See my next post.

Comments

The card reader is actually

The card reader is actually largely optional for most cases, but they don't go out of their way to make that clear...

On your Sign On screenshot, if you look closely, you'll see there are two tabs at the top. One, the default, is "Use your card reader". The other next to it is "Use your memorable data". If you clicked that, you'd be prompted for the old style login.

(They have since changed the login form since you took the screenshot, and the process of logging in with memorable details is now slightly different. Now there's a "Or, use your memorable data and passnumber to log in" link you can click)

Nick, I think you've

Nick,

I think you've misunderstood the post (not surprising given all the layers of confusing fail described). As I relate in the blogpost, I did spot the "Use your memorable data" tab and (after a lot of hassle) successfully logged in with it. But once I tried to actually do something after logging in - that is, transferring money out of my account - I was asked to use the card reader. Which, of course, is broken. That's why I rang them and questioned their use of the word "optional".

Of course, as I make clear in my next post, the impossible demand for me to use my broken card reader was a red herring anyway, because the nature of the account simply won't allow you to transfer money out of the account without an enormous amount of fuss. It simply can't be done online, or even over the phone, card reader or no card reader.

I stumbled across this blog

I stumbled across this blog post accidentally and would just like to point out that this is, in my opinion, a very unfair description of Nationwide's Internet Banking service. Setting up access is really easy and logging on is not as difficult as you make it sound. Why it took you 6 months I don't know!

Memorable data is something YOU are asked for when setting it up. YOU are asked to provide a name, place and date that is meaningful to you, one of which is required to login. The customer number and passcode are both sent in separate letters clearly stating that that is what they are. After requesting Internet Banking access and then having these pieces of information requested of you should not be a shock!

As for the problems you had with the card reader, I must say that you appear to manage to use a computer which is a much more complex piece of technology, so I don't know why you had a problem. It doesn't require any 'setting up'. When you are required to use it, the website provides you with exact instructions on the buttons you have to press.

There is nothing broken about the card reader. If you don't understand the concept of two-factor authentication I suggest you google it and learn about what it is you are blogging about!

It would appear that your problems stem mainly from an inability to read letters and follow instructions. If you would like assistance with using Internet Banking please let me know, I'd be happy to put you right.

I think the problems with

I think the problems with internet banking are different for different people. I've had a nationwide account for some time now and it does actually suck for me. I had to request a new card twice before they sent me one, the banking system went down and it locked my account taking 2 weeks to get a new pass code. The card reader doesn't neccessarily work for me. I had the pin for one of my savings cards in front of me and it denied it and locked my card. Sometimes for some unkown reason the code is a number short...this might be the screen. Every time I try to use the password verified payment it says the password is wrong when it is definately not, then when it asks me to change the password and I enter the password I've been trying to use it says is can't be the same as the last one.

It's frustrating to be constantly running up against bugs in Nationwide's system though it's nice to see that other people don't have problems and it makes me hopeful that one day I won't, but I think it's unfair to say things like "It would appear that your problems stem mainly from an inability to read letters and follow instructions." Some people do have real problems with Nationwide banking, for some people it does suck. Maybe mine sucks in a different way, maybe it's not specific to internet banking and Nationwide is either just a crappy bank or the wrong bank for me but I think you are lucky to not have had problems with a system that is still working out the kinks.

Anonymous, you are right, and

Anonymous, you are right, and thanks for backing me up. Nationwide's "internet banking" (I'll call it that although I've made clear elsewhere it's not really internet banking) is fiddly and confusing even when it works as intended. Even if those stupid card readers work perfectly, the whole system is poorly designed. I would be astonished if I found out it had ever been fully user-tested.

Adam, I thought your comments

Adam, I thought your comments were so helpful that I've written a whole blog post all about you.

Your experiences with setting

Your experiences with setting up Nationwide internet banking are pretty much the same as my wife and I had, but there's more! I needed to transfer the whole of our lump-sum savings from a Mysave account to our Flex account for onward transfer to our main bank account to pay for an investment. Nationwide made me transfer the money £10k at a time, and every time I had to log in using the card reader (for these transfers they wouldn't accept anything except the card reader), so a transaction that should have taken a few minutes took ages - and then I couldn't get the money out of the Flex account immediately.

My latest experience is that since 3 October I have been trying to transfer funds from our Nationwide Regular Saving Account and I can see the money - it's there OK - but every time I try to transfer it I get "We're sorry. We seem to be experiencing some technical problems". Nothing else, no help offered, nothing. Basically just 'Go away'.

This time it's not so urgent, but when I have eventually got our money safely out of Nationwide's reach I am going to close ALL our Nationwide accounts including the ISAs and the Flex account itself, and turn my back on them completely. It's such a shame, I believe that the mutual building societies were a wonderful system, but I can't stand the hassle of using Nationwide.

Thanks for sharing your

Thanks for sharing your experience, Squigglepop. It's a nice balance to all the drive-by comments I get from people telling me I must be stupid to have any problems with Nationwide's internet banking. I'm very sorry to hear you've been put through all this crap and I hope the process of sorting out new money arrangements is easy and quick!

Haha..yes...couldn't agree

Haha..yes...couldn't agree more. Nationwide Internet banking is very unfriendly and obtuse. If all Internet banking was like this you could forgive them but its not.

I sure do miss the Money manager that Egg used to provide, as that made all these banking sites a breeze to use. I'm told there should be a replacement somewhere but haven't found it yet.

I travel a lot and find the Nationwaide such a pain having to remember a customer number that is not on any of my cards or cheque books...so what do I do..I write it down someplace. Seems to negate the whole point of it to me.

I'm still with them because I like the whole mutual thing, but they are a right pain the the &*^&

Thanks

Hi Kate, You'll be pleased

Hi Kate,

You'll be pleased to know, probably in the interests of security or usability, but achieving neither. As it stands now, when you register for a nationwide account you now have to enter a total of 8 pieces of memorable information (3 'memorable data' and 5 'security questions) about yourself.... I genuinely don't know the answers to enough of the questions to create my account ... I might have to hire a private investigator.

Awesome usability nationwide

You mean it's got WORSE in

You mean it's got WORSE in the 18 months or so since I wrote this blog post? Goodness me. Thanks for sharing.

I thought it was just me

I thought it was just me having this problem, thinking I could have forgotten 3 pieces of "memorable data" but nope, there are others! This will be my 3rd time re registering and I think I have also incurred a late payment fee, but I'm not entirely sure....because I can't log in to find out. I'm guessing purely because no money has been taken out of my current account yet. Ridiculous.

You have my sympathy!

You have my sympathy!

It's now 2014 and I am having

It's now 2014 and I am having the exact same problems as the orginal poster had. I am almost at the point of chucking my laptop out the window as it is so frustrating. Twice I have been locked out of my account and I haven't got in yet at all. I am also owrried that I am going to incur a late payment fee. I have used many internet banking sites and this is by far the worst so far.

Yeah, I was struggling also,

Yeah, I was struggling also, but:

if you use the "not card reader" "memorable data" input option on the right hand side, this is fine; if you remember the details you gave them of the pieces of memorable data (a name, a date, and a word I think), along with the 6-digit passnumber you gave them, you should be fine, so no need for card reader.

If only it was that simple,

If only it was that simple, Anonymous. As simple as leaving a drive-by comment on a blog post you haven't read.

Yes, I'm afraid to say that

Yes, I'm afraid to say that Nationwide Internet banking still sucketh.

I wanted to set up a simple online savings account - you know, so I wouldn't have to leave my chair to transfer money etc...

Well, the first thing I had to do was travel on 3 trains and a bus to 'verify' my identity at a branch. Good start Nationwide.

Secondly, after opening my account, the Nationwide IT system completely failed and couldn't register me. After several phone calls and a week later, they fixed it.

Two snail mail letters later and I finally get my welcome letter.

After entering customer and pass number, I'm then asked to come up with 5 security questions and answers in order to proceed.

You know what. I'm giving up.

Too much traction. Too little concern for usability and user friendliness. Too many similar comments online.

I wanted a simple, well designed *online* account, one that was designed for the 21st century.

I'm going back to the drawing board.

Nationwide... fix up.

It is still awful today. It

It is still awful today. It has been a month since I completed the online application, and I now have all the bits of paper that I need (some have been inexplicably sent multiple times), but I still cannot login.

The login page gives me "The customer number you entered doesn't match our records. Please try again.". Your blog rather suggested that I needed to register for online banking - so I dutifully did so... the first time I received an error message, but the second time it seemed to work, and I got an email saying I will soon receive a customer number, pass number and card reader. But I already have these things! They just don't get recognised by the login page.

It is not worth the hassle just to get 5% interest for one year.

If you think the banking side

If you think the banking side is difficult you should try resetting your mortgage rate! All the problems described above along with obvious bugs included. There is strange, circular route which leads you to log into your account twice. Still not managed the process and with no technical support available and branches reluctant to arrange meetings, the only way forward is to have an hour-long phone session, making the online offering totally pointless.

Oh Oh getting some of the

Oh Oh getting some of the issues you have experienced, keep getting am message "we are experiencing technical difficulties at the moment" when using the card reader, but can log on with security details, beginning to feel very nervous about opening an account as quite a number of people seem to be struggling !!

Same here - never even got to

Same here - never even got to open my account because they demanded a card reader which they never gave me and other problems - I wanted an online account since Nationwide have gradually moved branches further and further away - it's a special journey to go there. So I have given up on them and never used my internet account - when I went into town I moved my money out and am going elsewhere. I've been with them 40years but don't owe them anything when they are so difficult to use

I commented above mid last

I commented above mid last year and since then I have completely given up trying to get into their online banking site.

Also, I incurred a late payment fee of £12 because I made a payment too early! Apparently, there is a three or four day period after the last month's payment due-date, which does not count towards the next month's payment, so although my minimum payment required was £25, the £120 I paid overall for that month did not count!?! For three or four days there is a period of nothingness - it doesn't make any sense and is not practiced by anyone else I have used. Got my £12 refunded after taking it further, but they still ruined my impeccable credit file through no fault of my own and refused to acknowledge their unfair practice, leaving the credit mark in place.

Seriously, I wouldn't bother with Nationwide or their shambles of an online banking facility, and I shall be closing all my family's accounts with them.

Hi Kate, totally agree with

Hi Kate,

totally agree with your blog. I had a similar experience, and here's why:

The three parts of memorable data that is setup long before you are able to log in are a date, place name. Ok great. Easy.

however when it comes to logging in for the first time in say 2 weeks after the mail arrives it simply states:

"enter one of the memorable data". It should prompt to say "Enter your memorable date, or place or name". Because it is so vague (for security purposes) when requesting it doesn't trigger ones recall sufficiently. Memorable data? And you end up needing to write it down, defeating the purpose.

Secondly the customer number, this is the foremost online identification. if you lose it, you are stuffed and end up in a catch 22 situation.

Look online for "lost customer number" and it tells you to call them. When you call, in order to proceed you need your customer number, or current account number or mortgage. If you only have an ISA or savings account, you don't have a current account or card reader.

So like me you end up queuing in branch.

Thirdly and generally, Nationwide savings accounts setup online, they don't send you details of your account number and sort code. Again, a visit to branch is required to find out how to pay money into the account from another bank.

I gave feedback on all this when they called me. I must say the branch service is excellent. Online?

SUCKS.

After attempting to login to

After attempting to login to my account and being locked out for 60 minutes I tried again and correctly enter the numbers displayed on my pad and it still tells me inccorrect and has locked me out for another 60 minutes. This card reader system sucks. The Pin entered - PIN correct - then the number entered - correct - then it displays am 8 digit number - I enter online and it tells me it is wrong - the card reader generated the bl**dy number - I merely carefully entered it

First Direct online doesn't cause this much fuss - Nationwide Internet Banking and card reader SUCKS big time - useless and the account will be closed since total cr*p

Your brief was more helpful

Your brief was more helpful by far than anything nationwide posted

i was foxed by much of what irritated you too

they just make assumptions that your follow

now i can't even see the log on for memeroable data and the 24 hour line for intrnet help is no use i have just wracked up 10 minutes of IDD on three attempts with no one answering

How do i log on with meorable data, i am sure that feature is hiding, ?

u complained some years ago but no fixes

so messy

terrible bank! What

terrible bank! What they're doing isn't security it's a painful obsolete method that no one needs!

they should simplify things not complicate it. They sent me 5 different mails containing different passcodes, now how the hell will I be able to memorise all this nonsense.

I'm switching to RBS

totally agree,nationwides

totally agree,nationwides login process is the worst i have come accross, similar problems, cant login in without card reader, i dont even know my memorable names, places pass codes etc theres simply to many to remember, i also tried to use mobile banking, cant do that unless i carry my passcode and some other info in my wallet, so quite unsafe,, santander mobile banking app is secure and so easy to use, infact santander login for pc is easyto use, dont know why nationwide opted for this rigmarole of enter this, enter that, secret word here and there, then use card reader.

apart from that there a good bank...

I can't even login with the

I can't even login with the card reader, in fact I have three but they all end up with the "incorrect number entered" screen, despite carefully and bejesus I mean very carefully checking each number. Each time I get A triumphant "PIN CORRECT" message then a random passcode that never works. Yes, tried it with a space and without a space, even while being directed by a techy at Nationwide.

Now, bear with me, I have had the online account for over two years and not had a problem until a few weeks ago. The card works fine in an ATM. After 3 calls to the help desk, which unfortunately requires a telephone pass code, which is different to any other code or pets birthday, blood group, name of my greatgrandads cousin twice removed and the GPS coordinates of my exact place of birth required by Nationwide online banking. Ok, joking aside the amount of security needed makes the system vulnerable because we have to write it all down.

Now waiting for some new bits to be sent through in the post to try again. Failing this I think I will revert back to using my Halifax account, much more user friendly in all ways.

Great to read this as i have

Great to read this as i have just set up a account and it turned into a farce , asked over the phone to nationwide for help filling in a ISA transfer form to them they said do it online , so i tried to log on using the customer number then the memorable data bit and 3rd 4th 5th numbers from my memorable date , i had all this info written down so couldn't get it wrong , three attempts later and i now have had to re register and i have only done this so i can now close the account down once i get the new customer number , online as what started as a simple ISA transfer to my new nationwide account has become numerous phone calls and masses of paper spin booklets etc , setting up a online account previously with barclays and the co-op no problems at all , definitely not a good experience so somebody else can have my savings ,,..

Amazingly it's now 2016 and

Amazingly it's now 2016 and the setup hasn't changed.

We took our mortgage out with Nationwide in September last year. Everything you described in your blog post is EXACTLY how I have found it.

It took me until they sent me my 4th code for me to be able to get into see my mortgage details.

And after having not checked them for a few months I just tried to log on and cannot get in again!!! ARRGGGHHH!!! (This is why i googled to seee if others had had the same problems and your blog came up!)

So frustrating and unneccesary when you see how other banks and building societies do it!

Crazy that this post was

Crazy that this post was published in 2011 and people are still leaving comments to say they're having similar experiences. I don't know whether to laugh or cry!

I feel for you I have not had

I feel for you I have not had any problems with the online banking 'but' I cancelled my card in July and requested a new one it is the beginning of October now and still no card. A card reader arrived which I do not want. I just want a debit card. I have phoned four times and sent 10-15 online messages. Each time I am promised my card would be with me in 3-5 working days. I would complain in person at the branch but for some reason they will not allow you to take your dog in anymore! I am taking advantage of Halifax's offer of £100 for moving my account (in my case literally across the road).

Sorry to hear this, Pip. Is

Sorry to hear this, Pip. Is your dog a guide dog? If so, Nationwide might be breaking the law by not allowing it in.

I think it's a good move to switch accounts, but be warned: I've heard not-so-good stories about Halifax's rewards for switching - some people have really had to chase them to get the money. I hope it all goes smoothly for you!

Right, my bank card

Right, my bank card mysteriously disappeared at the airport the other day. I called Nationwide when I reached my destination and they cancelled my card, and asked them if I could transfer money to another account as I had no money on me, it was a definate NO! Apparently they don't have the facilities to do so over the phone...............What? Even Barclays indian call centres are better than this!

Anyway, she told me to use the Internet Bank, well logged in using memorable data, and tried to transfer money to my friends NATIONWIDE account, a transfer has been made in the past to this account not too long ago and was already saved.

Now bare in mind, i'm abroad and my card went missing and has been cancelled, the site wanted to use my Card reader for this! Why? I've made the transaction before and it was to another Nationwide account, so what's the big deal, even if it was fraudualent they would still be able to reverse it.

Anyway so rang back Nationwide again, they were unable to help and then demanded to speak to a manager, she said the emergency team is not here they've gone on holiday for christmas, It was 10am Christmas Eve, not a public holiday! and what is an emergency team for if its not there in times when emergencies usually happen? What's the point of an emergency team if it is open the same times as customer services?

Anyway, they said can you not use telephone banking? I said well, this is telephone banking isn't it? She said no, you should have received a 6 digit security code in the post, well she said I will send those details and a new card out and will received in 3 to 5 days, well pointless since i'm abroad and why didn't they send a telephone banking code before???

This whole internet banking really is rubbish and you should not need a card reader to transfer small sums of money to another Nationwide account that you've transfered to before.

I am also shocked that when I cancelled the card, they didn't even order me a new one, the lady I spoke to last ordered one.

This whole situation is unecessary and could be avoided if they review there security policies. The card reader does not protect you from fraud, it has been proven that they are totally useless.

After Nationwide's 5 million rounds of security, how come fraud is still going on?

Usless,unhelpful and pretty pointless bank!

The first opportunity, I am switching banks! Is there anything they do without screwing it up somehow?

I would have loved to leave a

I would have loved to leave a comment. But the captcha on this blog is even more painful than using Nationwide internet banking.

Ha! But...you did leave a

Ha! But...you did leave a comment?

Without the crd reader you…

Without the crd reader you are unable to set up new payments. I have just found this out as my card reader has suddenly stopped working and I have two urgent payments to make. I'm heading in the branch tomorrow for a new card reader on my lunch tomorrow dinner (an hour wasted) and am closing the nationwide account and transferring to another bank tomorrow night.

Thank God - I thought I was…

Thank God - I thought I was going mad. I live in Australia so only use my card occasionally, but whenever I do, (or try to) I have a sense of foreboding. I don't know how many times I've been locked out of my account after trying to check my balance. Then I have to wait til the small hours, phone overseas,get a new card, a new PIN and start the whole sorry mess over again. I've currently put the wrong PIN in again twice so daren't touch anything else on my card reader. I have no idea what memorable data is so I'm guessing I never signed up for that. Thing is, every other bank account I have does NOT rely on me having my card and card PIN to hand. I usually put in my customer number and whatever password I chose - and that's it. I hate the fact that checking the balance, or doing anything on Nationwide relies almost solely on the PIN number because if you make a mistake you lose ALL access to your bank accounts. And let's face it, 3 times isn't much - one for mistyping; one for bad memory ... and then you risk everything! Thank you - rant over :)

I entirely agree with this…

I entirely agree with this post. The site is to slow, the security is far from intuitive, and the web site sucks (anyone who has seen any other banking sites will not dispute this). Why they ask for 3 bits of security information baffles me. One would be more secure, 3 gives someone guessing it 3 times more likely hood of guessing it.

Its beaten me today :-(

I can't even enter my birth…

I can't even enter my birth date to set up the app, you have to scroll back a million times, just as you are getting near your birthday the app times out!

In the end I gave up. Too much hassle.

July 2017 and it is still…

July 2017 and it is still bad.

I opened an account a few weeks ago and have no memory of being asked for any memorable data. Card etc all arrived and working fine. Letter with internet pass code arrived but no card reader. Tried to re-register for internet banking without the card reader - seems simple enough except to complete the registration you need to enter the code sent to your phone or email account. The problem is, the text message took over an hour to arrive, by which time the registration page had timed out. I will await the card reader that I have had to re-order. Not impressed and beginning to regret opening this account. I travel a lot so depend on internet banking.

Nov 2017…

Nov 2017

New customers, NW sounded good but nothing but problems so far, confirmation of switch was followed by cancellation of switch the following day. I spent over an hour on the phone to sort this to learn it was a computer error that affected lots of customers, account now switched and internet banking set up...only problem is we can't transfer any money as we haven't had a card reader...I've no idea how we are going to transfer our mortgage and bills payment for next week now. I tried the card reader faqs but they don't open when you click on them and to top it all when I tried to use a Nationwide cash machine earlier with my new card it just said your transaction has been cancelled...I feel so welcome as a new customer and wondering what I've done...!!!

Oh my god - I am having…

Oh my god - I am having these issues as we speak. If only I had read this first I would never have signed up to this shambles of a bank. Internet access is appalling!

While I have no problems…

While I have no problems with the interwebs banking itself, I do have a beef with the monthly reminder emails I get for my bank statement and how it sits with GDPR now. They claim they are non-marketing despite the last one having a blatant link to their list of credit cards (indirect marketing at best) + the continual reminder to use their phone banking app (no thanks). I get no such useless emails from e.g. Halifax (who's online banking does comparatively suck).

Apparently the only alternative is to go back to tree-killing and get paper spam instead..